Home Improvement Deduction 2024 – 30,000 per annum. There are some simple steps that are needed to apply for a home improvement loan and to get the tax benefits. Before we get into the idea of tax deductions and all the other . The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you .

Home Improvement Deduction 2024

Source : smithpatrickcpa.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

2024 Home Improvement Spend Outlook: Economic Uncertainty’s… | HIRI

Source : www.hiri.org

What Are Home Renovation Tax Credits? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

2024 Home Improvement Spend Outlook: Economic Uncertainty’s… | HIRI

Source : www.hiri.org

Justice Tax, LLC on LinkedIn: #taxdeducibles

Source : www.linkedin.com

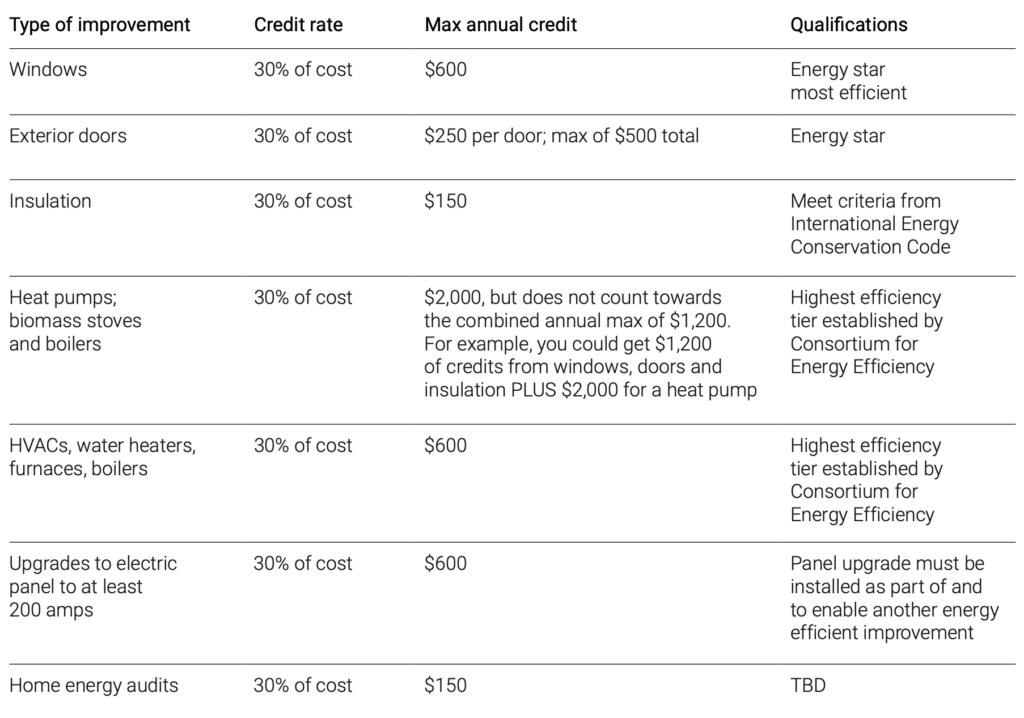

Tax Credits for Energy Efficient Home Improvements | Kiplinger

Source : www.kiplinger.com

Tax Deductions on Home Improvement Projects | TaxAct Blog

Source : blog.taxact.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Home Improvement Deduction 2024 Green Home Improvements? Get Tax Credits with Inflation Reduction : The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount. . The Biden $15,000 First-Time Homebuyer Tax Credit: Announced as a campaign goal of Joe Biden in 2020 but never enacted. The President recently floated a $10 billion down payment assistance proposal .